Record business expenses in KidKare to help you with your tax deductions each year. Some examples of expenses you could enter include, but are not limited to:

- Activity Expenses (Admission Fees to Amusement Parks, Museums, Etc)

- Advertising (Business Cards, Flyers, Ads, Etc)

- Apartment/Home Rent

- Appliances (Washer, Dryer, Etc)

- Cleaning Supplies (Detergent, Paper Towels, Soap, Etc)

- Business Software (Including KidKare)

- Office Equipment (Computer, Printer, Desk, Fax Machine, Etc)

- Food

- Furniture

- Home Repairs and Maintenance

You can also claim expenses purchased second-hand from garage sales and resale websites. Document the purchase when you pick the item up. Include the item purchased, date of purchase, purchase price, address/location of the purchase, a photo of the purchased item (if possible), and any other relevant or identifying information. For more information about reporting expenses, see Tom Copeland's blog.

- From the menu to the left, click Accounting.

- Click Expenses. The Expenses page opens.

- Click

. The Add/Edit Entry page opens.

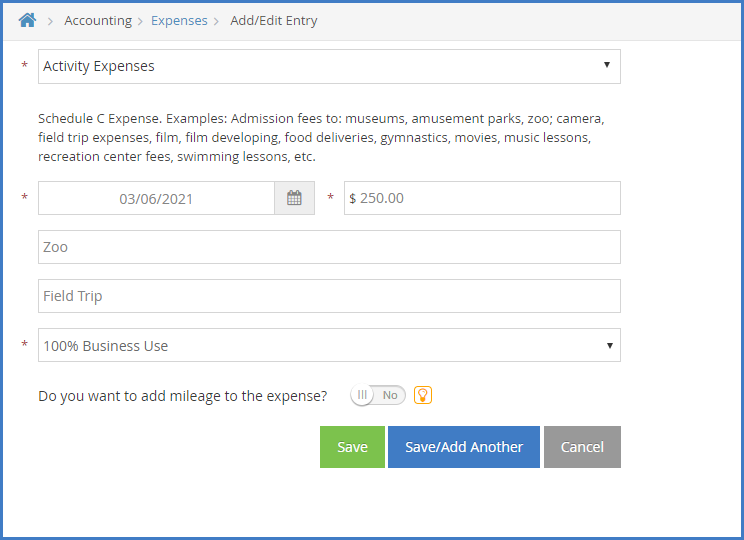

. The Add/Edit Entry page opens. - Click the Category drop-down menu and select the expense category.

Note: If you notice expense categories you do not need, you can hide them from this list. To do so, click

next to the category to hide and respond to the confirmation prompt. If you hide an expense category, you must create a custom category to return it to the list. For more information, see Add a Custom Expense Category.

- Click the Select a Day box and enter the date of the purchase/expense.

- Click the Amount box and enter the dollar amount of the expense.

- Click the Paid To box and enter the name of the entity/person you paid for the product or service.

- Click the Item Description box and enter a brief description of the purchase, if needed.

- Click the Business Use drop-down menu and choose from the following:

- 100% Business Use: The expense was used only for business purposes.

- Actual Business Use: The expense was used for both business and personal. If you select this option, indicate the exact percentage that was used for business.

- Time/Space %: The expense was used for both business and personal. If you select this option, you can use the time/space percentage to calculate the amount used for business. You calculate the Time/Space % on the Time/Space tab.

Note: If you selected Wages Paid to Employee in Step 4, the Business Use drop-down menu is disabled.

- Click

next to Do You Want to Add Mileage to the Expense if you want to record mileage. Once you save this entry, you will be taken to the Mileage tab to add the mileage.

- When finished, click Save. You can also click Save and Add Another to save this entry and immediately add a new one.

. The Add/Edit Entry page opens.

. The Add/Edit Entry page opens. next to the category to hide and respond to the confirmation prompt. If you hide an expense category, you must create a custom category to return it to the list. For more information, see

next to the category to hide and respond to the confirmation prompt. If you hide an expense category, you must create a custom category to return it to the list. For more information, see

next to Do You Want to Add Mileage to the Expense if you want to record mileage. Once you save this entry, you will be taken to the Mileage tab to add the mileage.

next to Do You Want to Add Mileage to the Expense if you want to record mileage. Once you save this entry, you will be taken to the Mileage tab to add the mileage.