Understand Form 1099-K

If you received over $600 (over any number of transactions) in parent payments via ePay for a calendar year, you should have received a Form 1099-K information report. This form lists the gross amount of all reportable card transactions/third-party network transactions.

For more information about Form 1099-K and what you should use it for, see Understanding Your Form 1099-K and Form 1099-K Frequently Asked Questions on the IRS website

1099 Fee Reconciliation Report

The 1099-K that Stripe creates includes transaction fees paid by either you, as the provider, or parents as well as the amounts received from Stripe Payouts. This will look like one lump sum.

In order to properly fill out the Expenses section of Part II of your Schedule C you will need to be able to separate out how much of the overall amount within the 1099-K should be considered Income vs. Expenses. Fees paid by either you or the parent can be considered Expense, payouts from Stripe are considered Income.

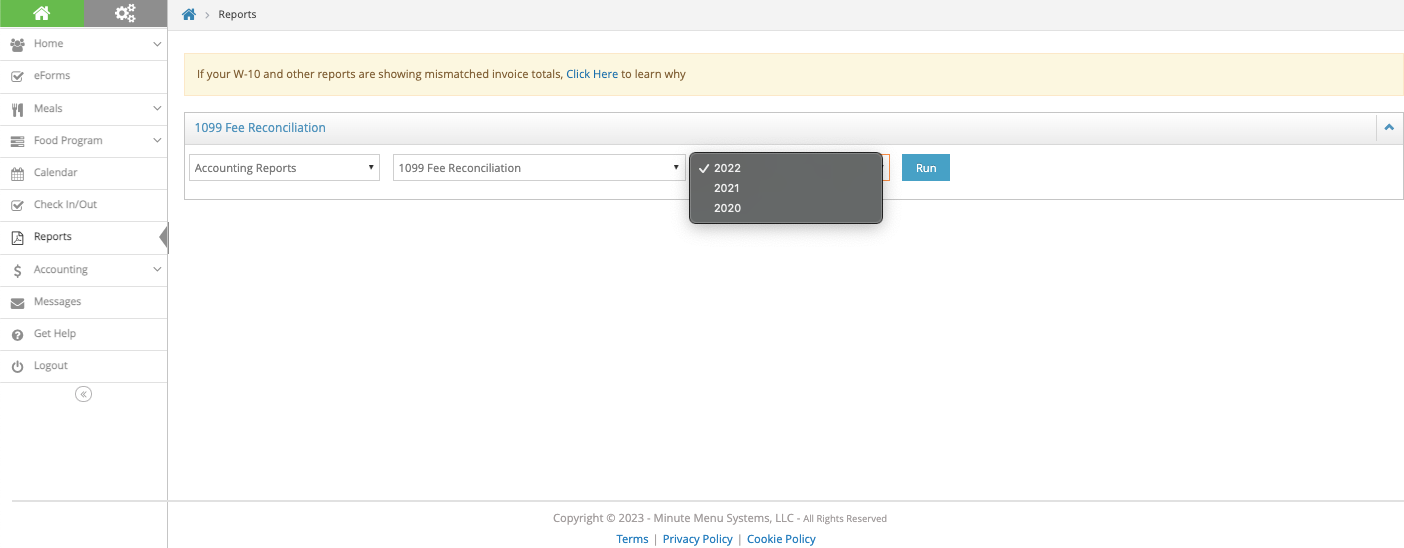

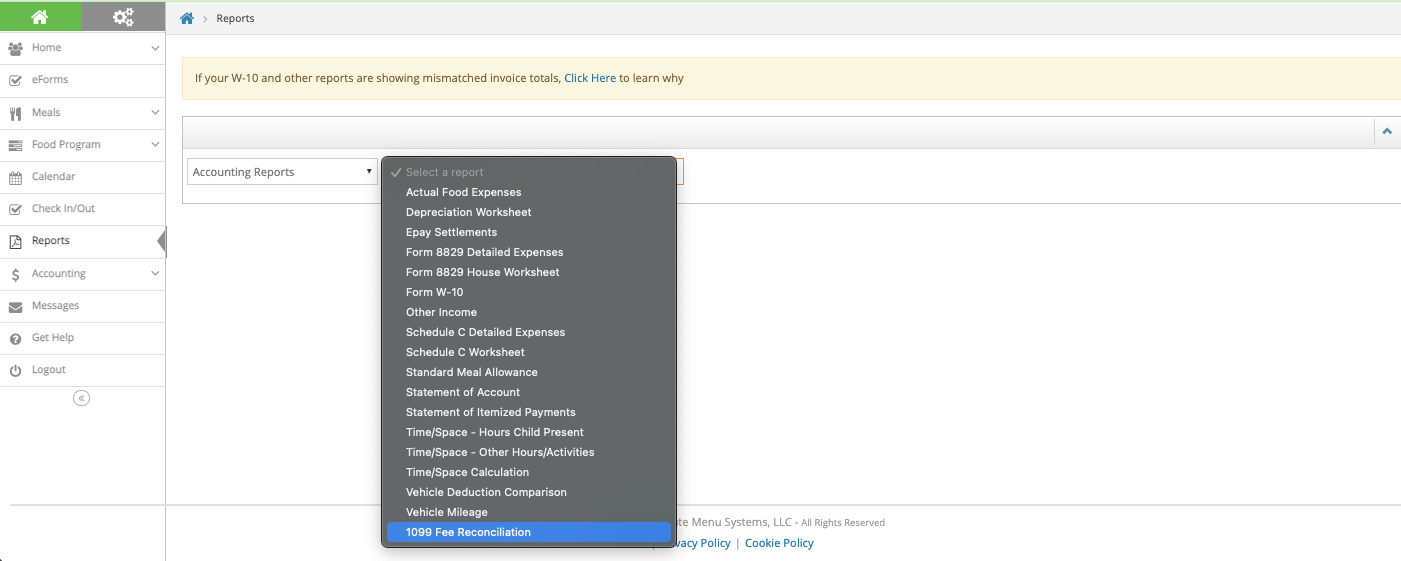

You can see the totals broken out in the 1099 Fee Reconciliation Report by navigating to the Reports section, selecting Accounting Reports, and clicking on 1099 Fee Reconciliation.

From here you can select which year you would like to run the report for, this report becomes available for the previous year at the end of January.